The Secret Sauce Behind Successful Businesses – Unlocking the Mystery of MOATs

Hey Longterm Squad,

Welcome back to another edition of “Finance Findings,” your go-to source for all things money, curated by Pratik Chauhan. Today, we’re delving into the intriguing world of business strategies and uncovering the magic ingredient that makes successful businesses stand out – MOATs.

What’s a MOAT, and Why Should You Care?

Imagine you start a local shoe business. Your unique designs and quality craftsmanship make your shoes the talk of the town. Business is booming! Now, here’s the twist – a competitor notices your success and decides to jump on the bandwagon. They start selling shoes that look similar to yours. Suddenly, your profits and market share start declining.

This scenario is not just a local business woe; it’s a tale that unfolds on a grand scale in the world of capitalism and the protective barrier that keeps competitors at bay, known as a MOAT, is the key to long-term success for businesses.

In the words of the legendary Warren Buffett, “The most important thing to me is figuring out how big a moat there is around the business. What I love, of course, is a big castle and a big moat with piranhas and crocodiles.”

A MOAT, or competitive advantage, could be anything that sets a business apart.

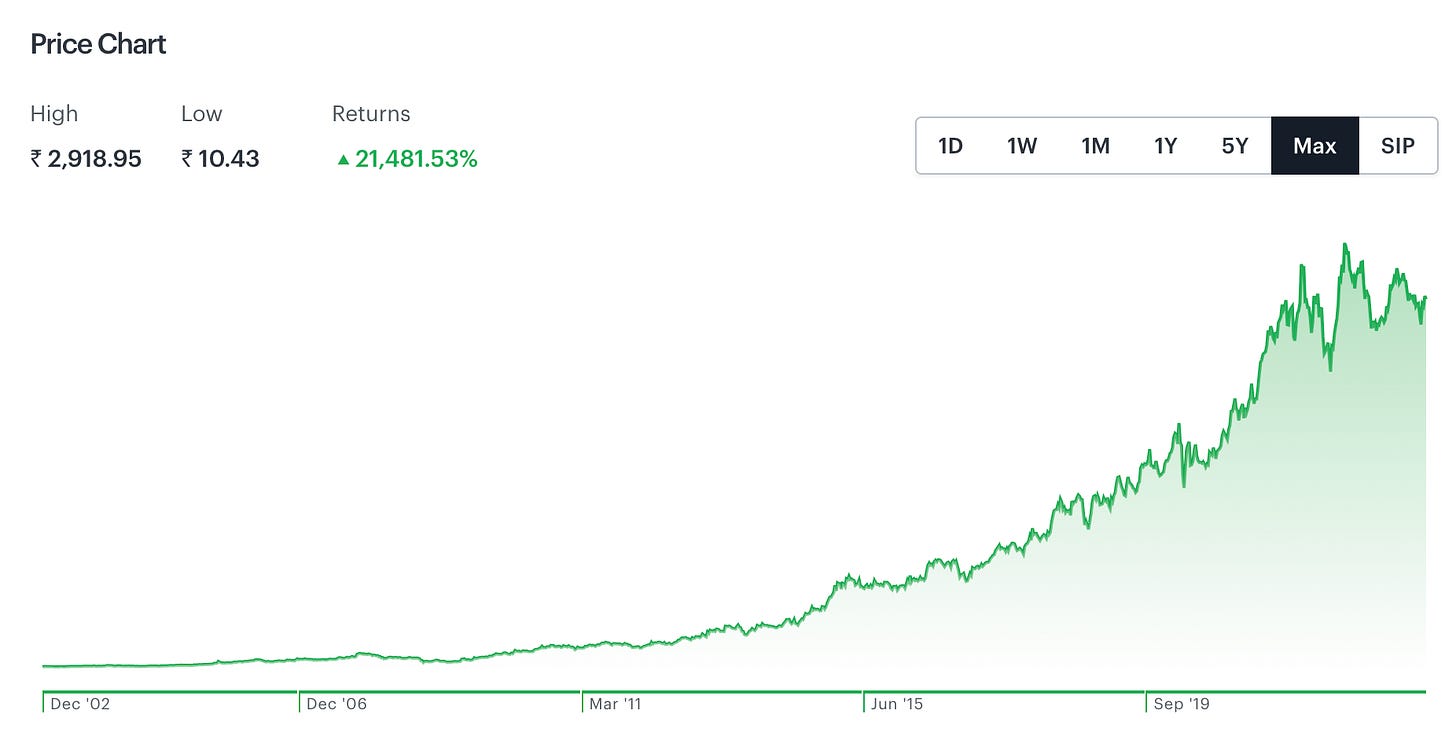

- Brand Moat: Fevicol’s Glue that Sticks and Stays

Pidilite’s Fevicol has become synonymous with reliable adhesion. This brand moat has not only kept competitors at bay but also propelled Pidilite’s shares to new heights over the last decade with over 780% whopping returns

- Distribution Moat: Hindustan Unilever’s Reach Everywhere

HUL has over 9 million Retail outlets reach and 9 out of 10 households in India at least use 1 product of HUL. This is a huge distribution where customers can find HUL’s products anywhere in India.

- Taste Moat: Maggi’s Unbeatable Flavor

Nestle’s Maggi has a taste that keeps customers coming back for more. This taste moat has secured a substantial 76% market share in instant noodles in India, translating to impressive share returns of over 400% in the past decade

- Network Effect Moat: Instagram’s Social Symphony

Instagram thrives on the network effect – the more users, the more valuable the platform. You would not like to be on any social platform where your friends and family members are not there, would you? This moat has not only made Instagram a profitable venture for Meta (formerly Facebook) but has also shown impressive share returns over the years.

- Regulatory Moat: ITC’s Regulatory Advantage

ITC dominates the Indian cigarette market with a 75% market share. Regulatory restrictions on advertising benefit ITC by making it very difficult or we can say next to impossible for any new player to create a brand in this market.

- Switching Moat: TCS and Unbreakable Bonds

TCS’s comprehensive IT solutions create a switching moat. Clients find it challenging to switch as TCS manages their entire IT infrastructure, fostering customer stickiness and substantial share appreciation over the years.

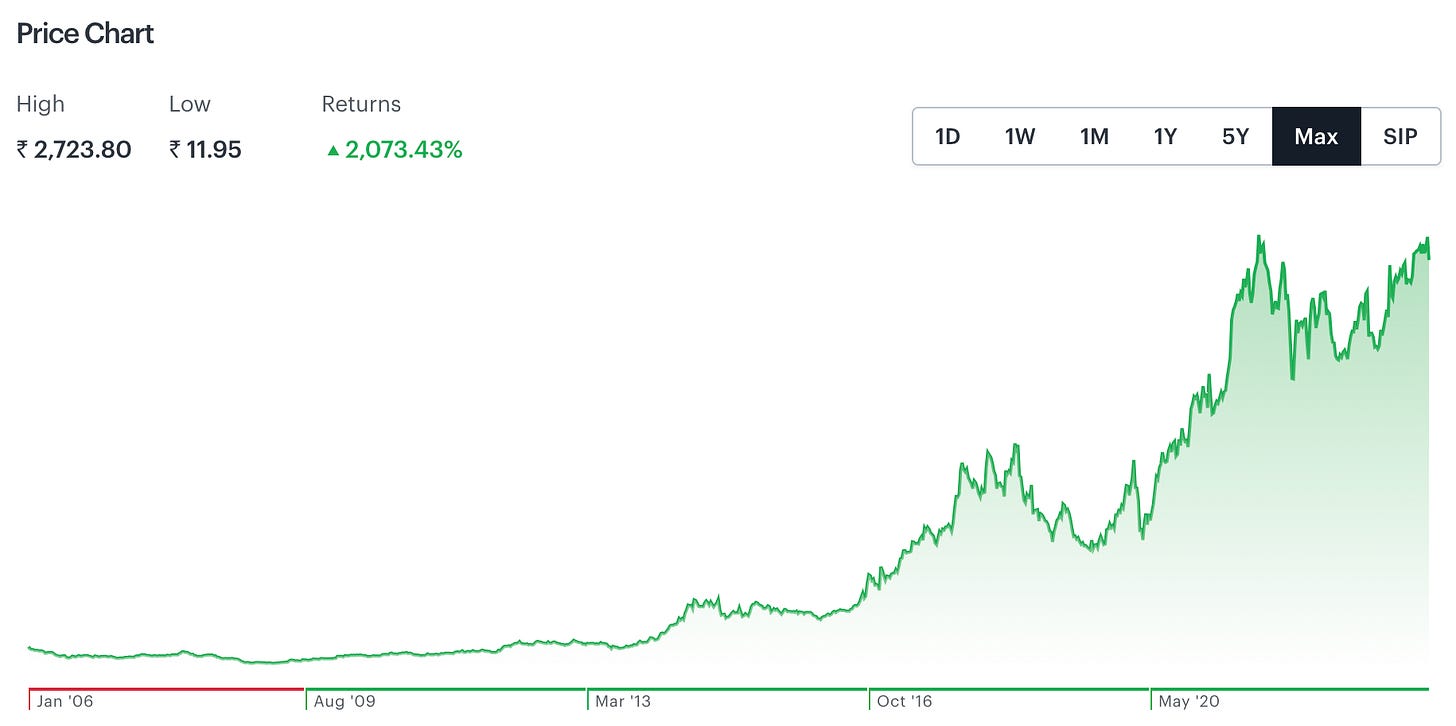

- Technical Know-How: Navin Fluorine’s Expertise Shield

Navin Fluorine’s technical know-how in the fluorine industry acts as a barrier for competitors. This expertise has been reflected in a robust share performance over the past decade.

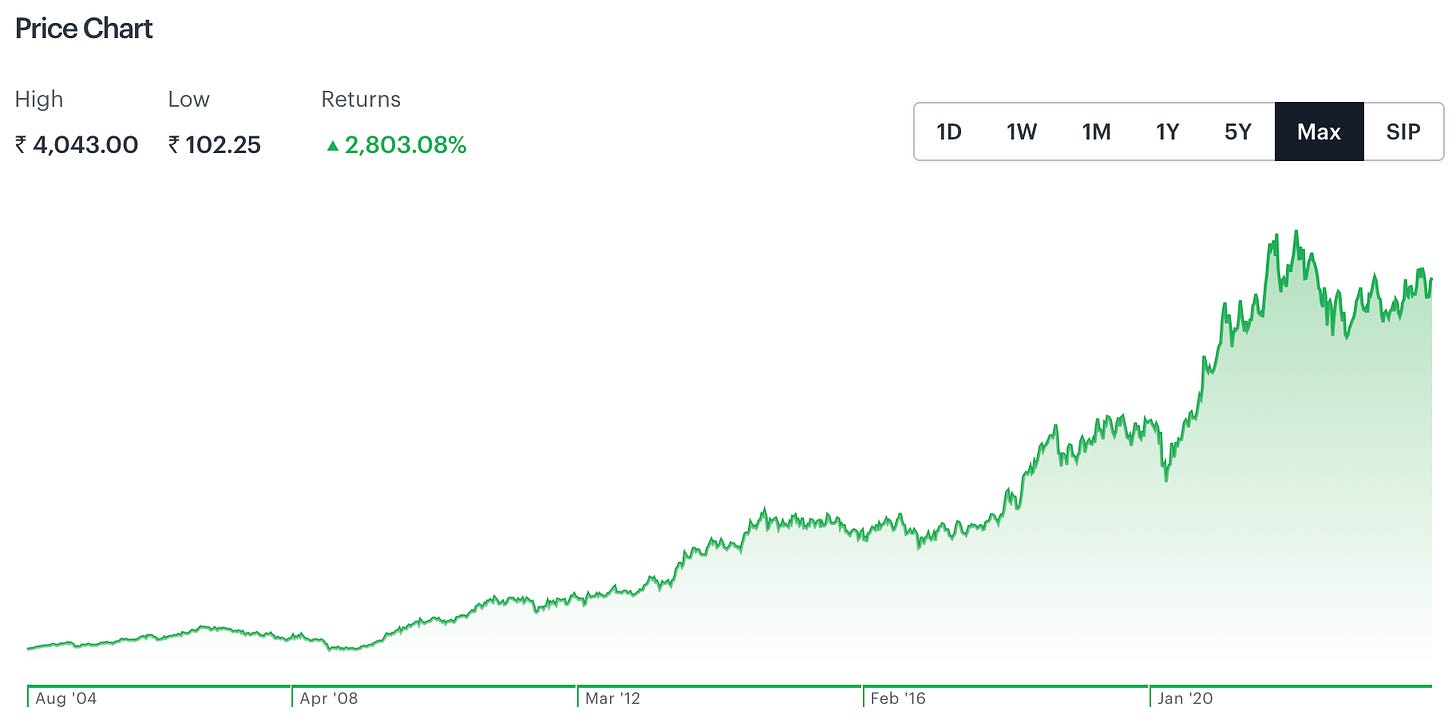

- Low-Cost Producer: Balakrishna Industries’ Global Traction

Balakrishna Industries, with its low-cost production of Off-Highway Tires, competes globally. Thanks to affordable Indian labor, they’ve garnered a significant market share and impressive share price growth of over 2300% in the last 10 years.

Understanding these MOATs gives us a peek into what makes businesses resilient and successful. Whether it’s a strong brand, wide distribution, unbeatable taste, or a technological edge, MOATs are the building blocks of enduring businesses.

So, the next time you’re eyeing a potential investment or evaluating a business, ask yourself: What’s the MOAT?

Stay tuned to “Finance Findings” for more insights into the fascinating world of finance!

Happy Investing!

Pratik Chauhan

Finance Findings Newsletter