Decoding IRCTC: A Monopoly Worth Investing?

Hey Longterm Squad!

Welcome back to another edition of “Pratik’s Finance Findings,” where we break down the complexities of the financial world into bite-sized insights. Today, we’re diving into the fascinating realm of IRCTC.

Established in 1999, IRCTC (Indian Railway Catering and Tourism Corporation) isn’t your average company. It’s a Mini Ratna, holding the prestigious Category 1 status among Central Public Sector Enterprises. What sets it apart? Well, it’s the sole player authorized by the Indian government to handle online railway ticketing, catering services, and packaged drinking water distribution across the nation’s vast railway network.

How Do They Make Money?

IRCTC majorly has 4 business segments!

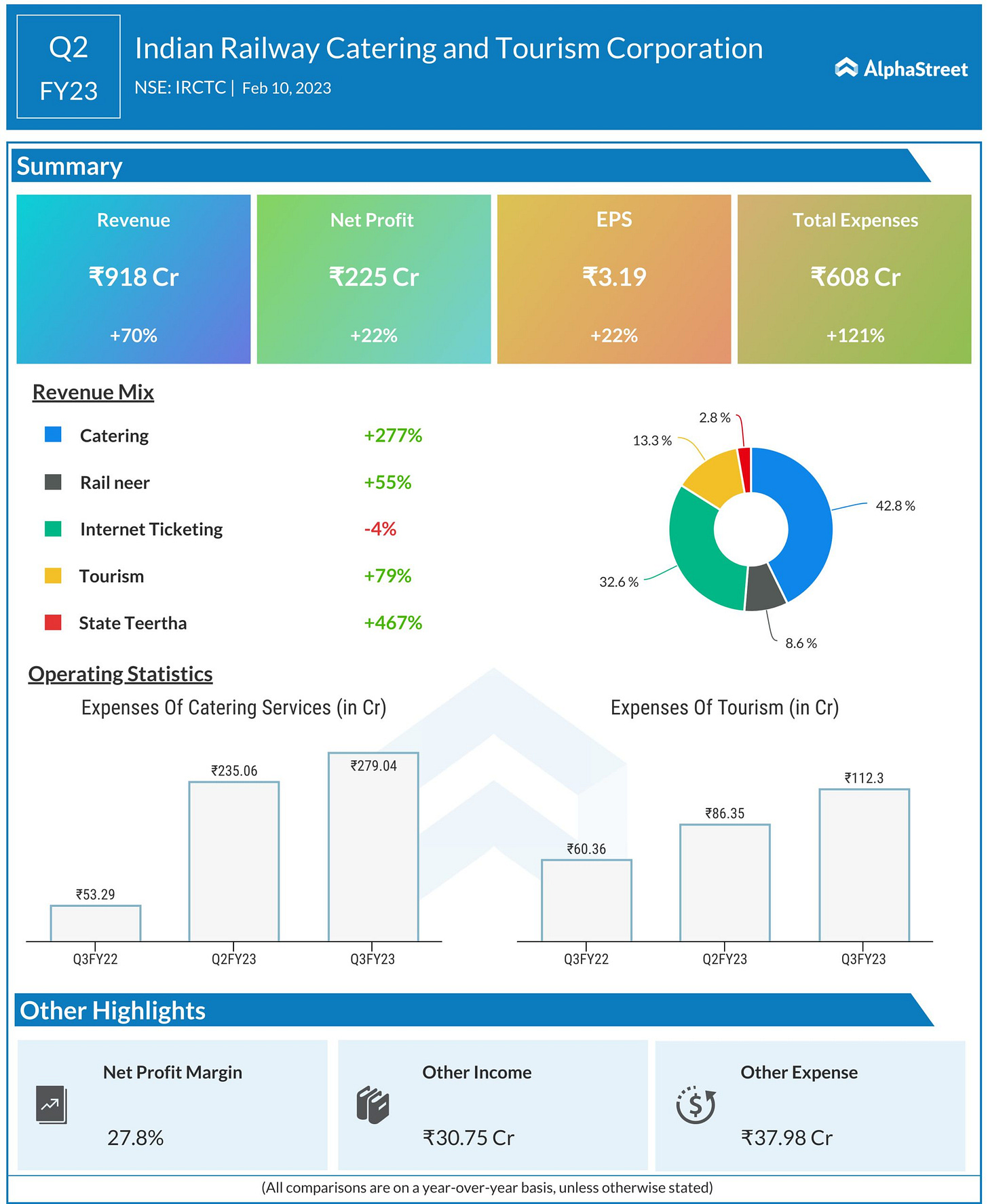

1. Internet Ticketing (32.6% Contribution in Revenue Mix):

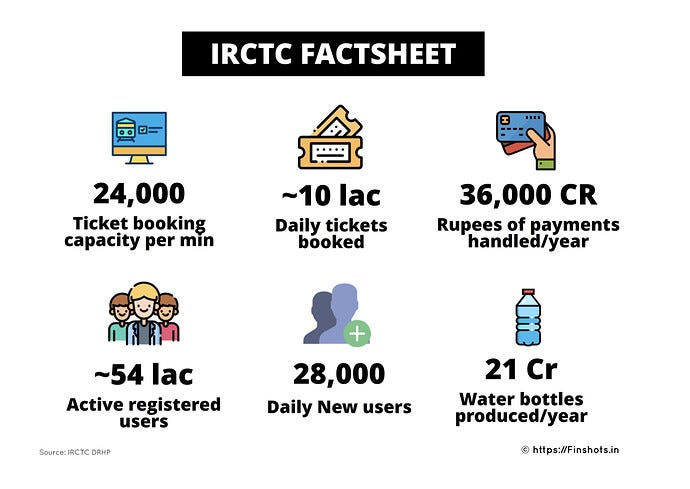

– IRCTC is the go-to for online railway tickets, serving a whopping 71.42% of Indian Railways’ online bookings.

– Picture this: 4,313 lakh tickets were booked in FY23 through irctc.co.in and Rail Connect, with 359.42 million transactions per month and 6.12 million logins daily.

2. Catering (42.8% Contribution in Revenue Mix):

– From mobile catering on trains to static catering at stations, IRCTC caters to around 350 trains and 530 static units.

– They’ve got it all – mobile catering units, base kitchens, refreshment rooms, food plazas, and more.

– Executive lounges, budget hotels, and retiring rooms? Yep, they’ve got those too.

3. Packaged Drinking Water (8.6% Contribution in Revenue Mix):

– Exclusive rights to ‘Rail Neer,’ the only authorized brand for packaged drinking water on trains and stations.

– 10 Rail Neer plants, producing 1.09 million liters per day, covering 45% of the current demand.

– Expanding to new locations and introducing water vending machines for your hydration needs.

4. Travel & Tourism (16.1% Contribution in Revenue Mix):

– IRCTC is your one-stop-shop for all things travel – hotels, rail, land, cruise, and air packages.

– While facing some competition in tourism, they hold a firm grip on rail bookings, thanks to regulations.

Why Are They Making This Money?

1. Regulatory Advantage:

– Monopoly alert! IRCTC dominates in 3 out of 4 business lines due to regulations.

– The Catering Policy of 2017 gives them an edge in the railway catering domain.

– In the packaged drinking water arena for Indian Railways, they’re the only player.

2. Pricing Power:

– Limited pricing power, especially evident during government directives.

– Tender processes and fixed charges are the norm, posing challenges in flexing pricing muscles.

How Will They Make More Money?

1. Growth in Rail Passengers:

– Suburban and non-suburban passenger traffic growth, especially in upper-class reservations.

– Anticipated uptick in second-class mail/express ticket bookings.

2. Catering Revenues:

– Projected 7.5-8.5% CAGR growth in catering revenues till 2025.

– Driven by increased passenger traffic and expanded catering services.

3. Packaged Drinking Water:

– Rail Neer is expanding coverage through PPP, targeting a 2.1%-2.2% market size growth.

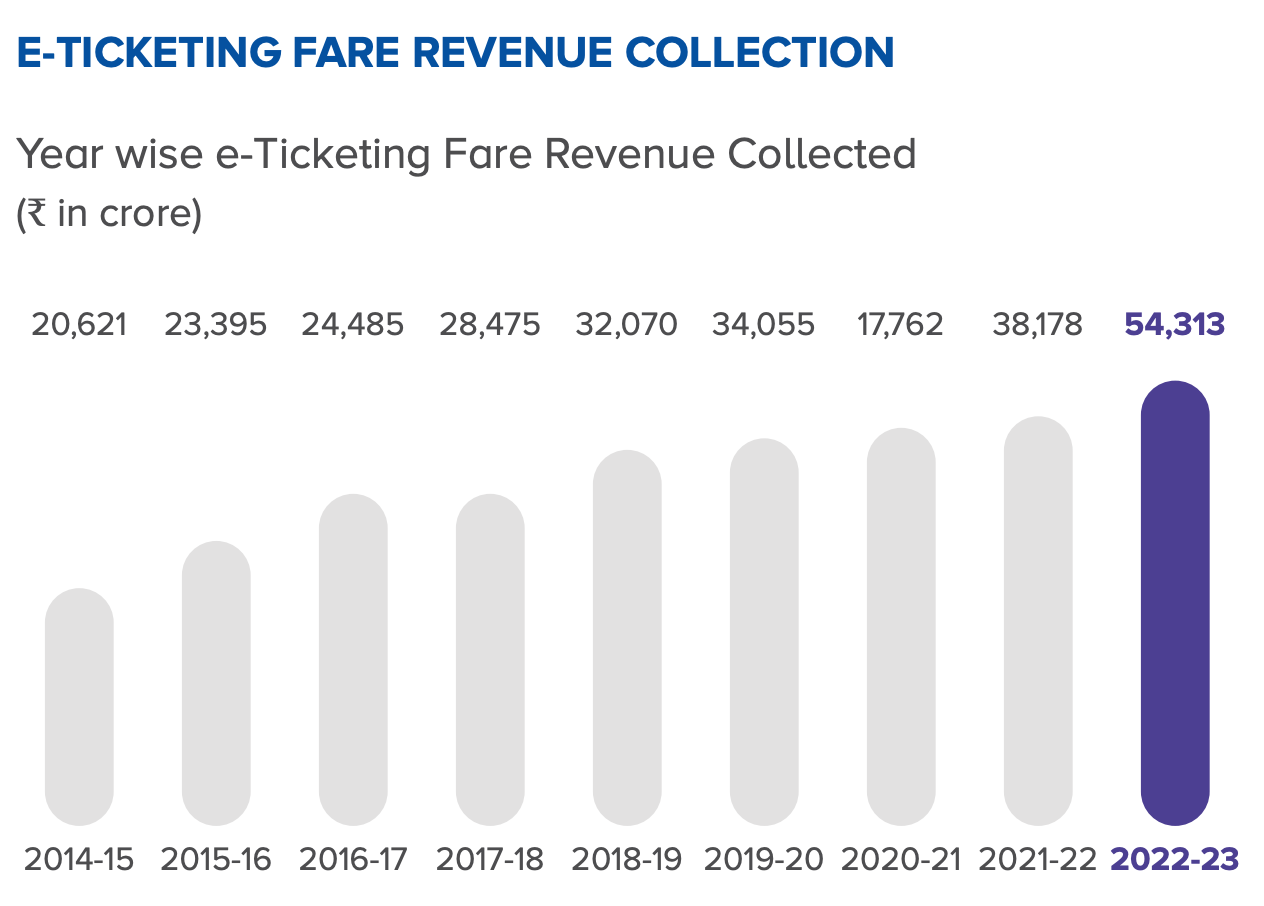

4. Travel, Tourism & E-booking:

– Expected 16%-17% CAGR growth in e-booking till 2024.

– Government initiatives boosting tourism, providing a fertile ground for IRCTC’s expansion.

Conclusion:

IRCTC’s Achilles heel is its golden ticket – monopoly. Any regulatory shift could alter the game. As of now, it sits comfortably, capitalizing on the surge in travel and online ticketing. For retail investors, keep an eye on regulatory shifts; it’s the key to sustaining this monopoly.

*Disclaimer: Not Invested. Not a registered advisor.*

Stay tuned for more financial insights, and until next time, happy investing!

Cheers,

Pratik’s Finance Findings Team