Will This Sector Outperform in 2024?

Dear Longterm Squad,

In this edition of Finance Findings, we delve into the intricacies of the Indian banking sector’s recent underperformance, whether this sector is worth investing in the current situation, and where I am invested in this sector.

Chapter 1: Why is the Banking Sector Underperforming?

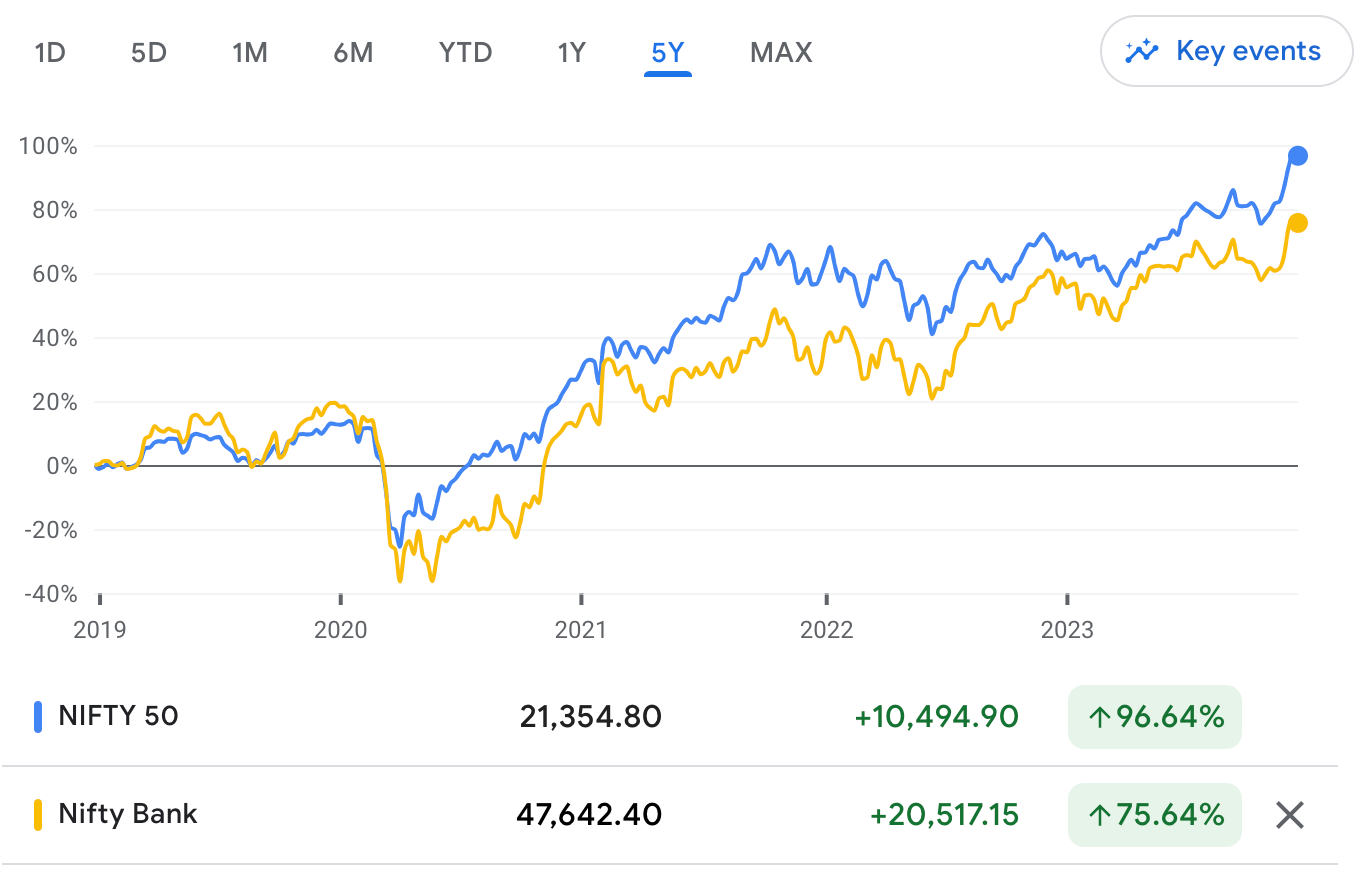

Over the past five years, it is evident that Bank Nifty has significantly lagged behind Nifty in terms of performance.

I believe there are primarily two reasons contributing to the underperformance of the banking sector.

- FIIs are Selling Since November 2021

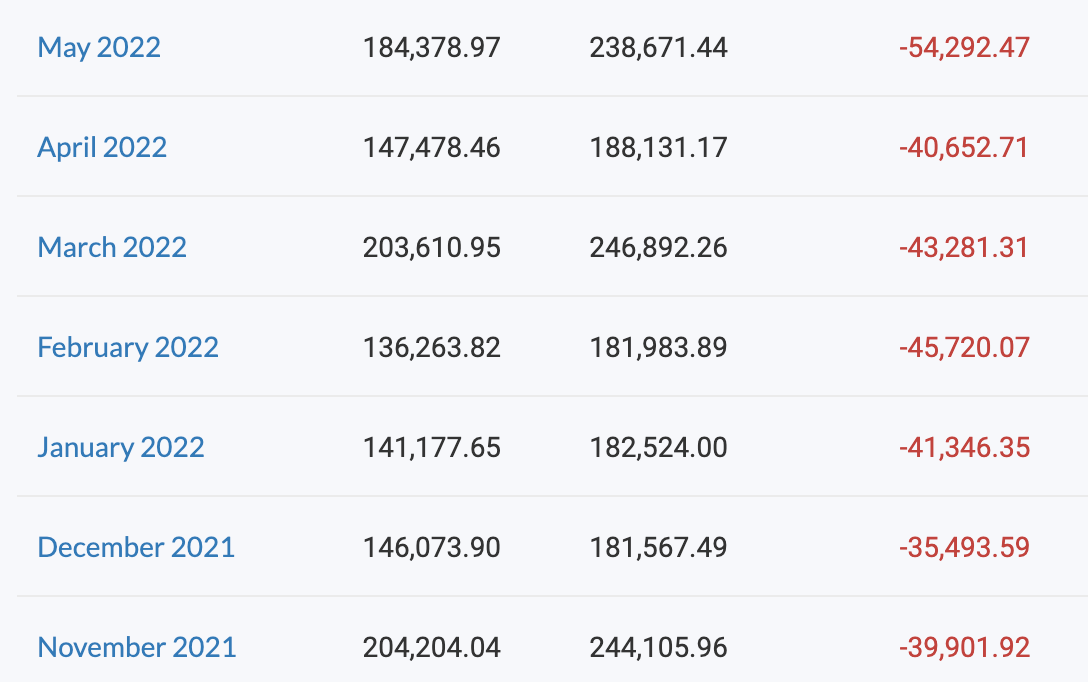

Foreign Institutional Investors (FIIs) play a significant role in the Indian Equity Market. Observing their recent activity, it becomes evident that they are net sellers.

FIIs Trading Activity

This is particularly impactful because a substantial portion of their selling activity targets the Index i.e. Sensex and Nifty. Given that the Banking Sector holds a weightage of 35% in the Index, the indirect result is a considerable outflow from the Indian Banking Sector leading to underperformance.

- Contraction of Net Interest Margins Due to Increasing Interest Rates

To comprehend why this matters, let’s break down the concept of Net Interest Margin (NIM) in simple terms. Net Interest Margin is essentially the difference between the interest income a bank earns through loans and the amount it pays to lenders (interest expenses) which is the interest a bank pays to their depositors on saving accounts, term deposits, etc.

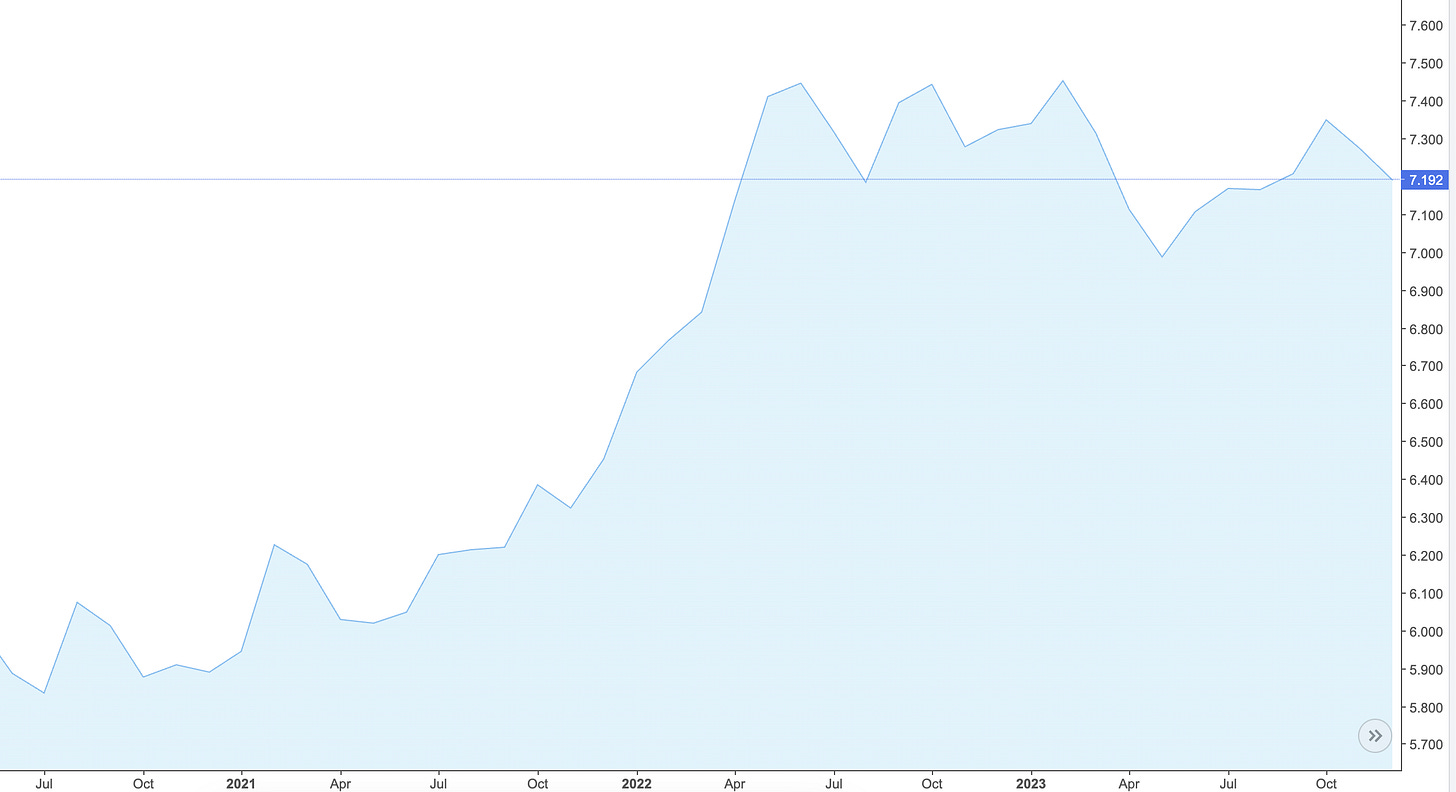

As interest rates have surged from approximately 4.5% three years ago to around 7.5% now!

India’s 10-Year Bond Yield

Due to this banks face a higher cost of capital. This results from borrowing money at elevated rates and offering increased interest on savings accounts and fixed deposits.

To preserve profit margins or NIM, banks raise interest rates on loans. However, this transition takes time, and as a consequence, most banks have reported a contraction in their Net Interest Margin in recent quarters which is a negative thing for investors, contributing to the underperformance of the sector.

Chapter 2: Why I am Bullish on the Banking Sector?

- The Credit Cycle is Robust

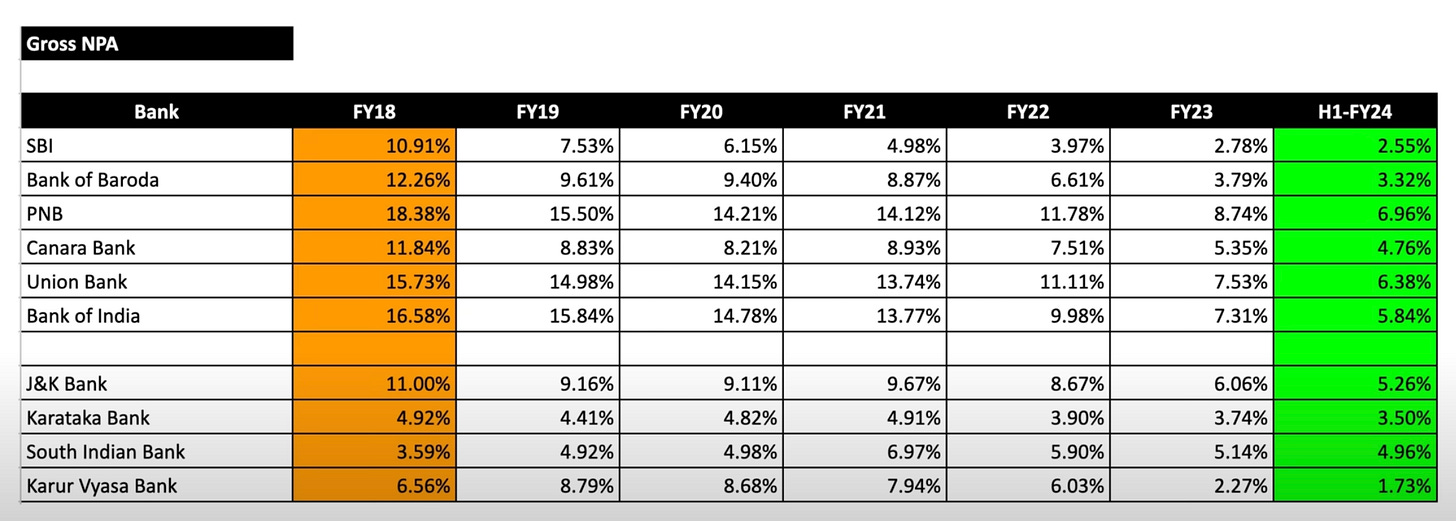

To gauge the health of the banking sector, understanding terms like Gross NPA (Non-Performing Assets) and Net NPA is essential.

GNPA stands for gross non-performing assets. GNPA is an absolute amount. It tells you the total value of gross non-performing assets for the bank in a particular quarter or financial year, as the case may be.

-NNPA stands for net non-performing assets. NNPA subtracts the provisions made by the bank from the gross NPA. Therefore net NPA gives you the exact value of non-performing assets after the bank has made specific provisions.

Examining the Gross NPA of banks, even those considered not so robust, reveals improvement and stability. This suggests a positive trend in asset quality which is a promising sign for the sector.

- Good Loan Growth

Listening to the conference call transcripts of major banks, a unanimous projection of 12% to 15% loan growth for the future emerges. This consensus supports the notion that the credit cycle in the banking sector remains robust.

- Valuation Comfort

Due to the recent underperformance, the current valuations of the banking sector provide a sense of comfort.

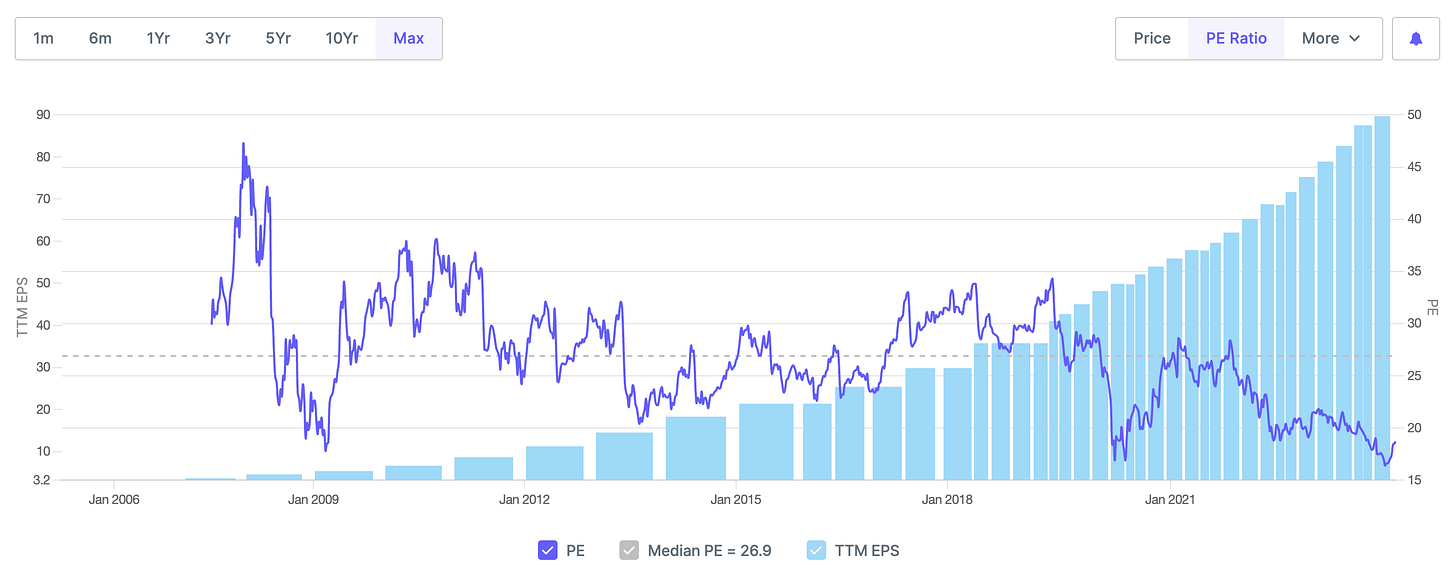

For example, HDFC Bank is trading at 20 year low PE Multiple.

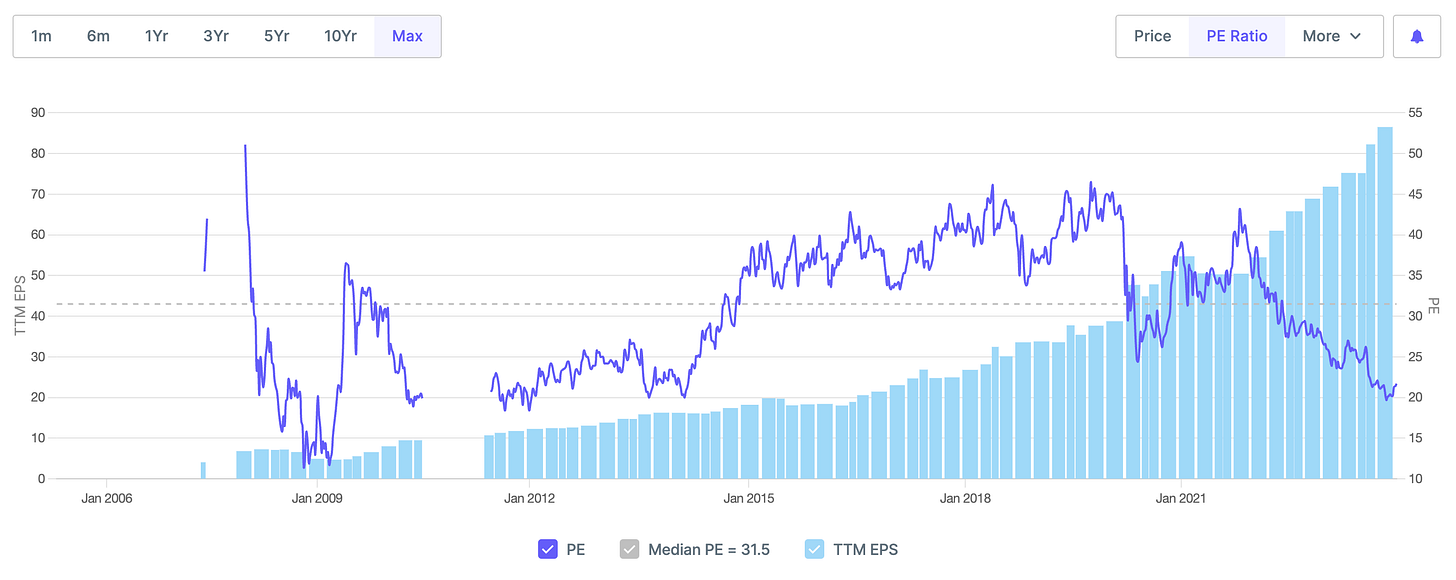

Kotak Bank is trading at 10 10-year low PE Multiple.

This presents an opportune moment for strategic investments, aligning with the belief that the sector is on the verge of a recovery, with an assumption of Foreign Institutional Investors (FIIs) starting to be a net buyer again and the potential for Net Interest Margins (NIMs) to expand in the future.

Chapter 3: Where I’m Invested in the Banking Sector?

In my portfolio, I have strategically chosen three banks, each contributing to a diversified and resilient banking investment strategy.

- Equitas Small Finance Bank

- Buying Price: ₹53

- Current Profit: 100%

- The rationale behind this investment was the arbitrage opportunity presented during the merger of Equitas Holdings with Equitas Small Finance Bank. Additionally, the bank’s overall performance was commendable. For a detailed discussion, refer to this video.

- Kotak Mahindra Bank

- Buying Price: ₹1777.23

- Recently added to the portfolio based on attractive valuations trading at a decadal low PE and PB multiple.

- HDFC Bank

- Buying Price: ₹1504.31

- Another recent addition to the portfolio, HDFC Bank was chosen for its compelling valuation, trading at a decadal-low PE and PB multiple. The bank, with its honest and capable management, stands as one of the leading private banks in the country.

Disclosure: I am not a SEBI registered advisor, and all views expressed are personal. This newsletter does not constitute a buy or sell recommendation.

Stay tuned for more financial insights, and until next time, happy investing!

Cheers,

Pratik’s Finance Findings Team